Types of Financial Documents

In the field of check collecting, “check” is a generic term and often applies to many kinds of financial documents, including not only checks but drafts, bills of exchange, certificates of deposit and promissory notes. The images that follow show an example of each of type of document.

They also show examples of the use of revenue stamps on financial documents. There are two types of these stamps, imprinted (printed directly on the document,) and adhesive (affixed to the document in the same manner as a postage stamp.) The revenue from these stamps was used to finance both the Civil War and the Spanish-American War. Revenue stamps were also used on many other types of documents and articles, particularly the Civil War revenues. These include stocks and bonds, mortgages, bills of lading, telegrams, insurance policies, wills, patent medicines, matches and perfumes.

As an aside, If you have a financial document issued prior to the late 1800’s, and it is signed by a woman, you have something unusual. It was a man’s world.

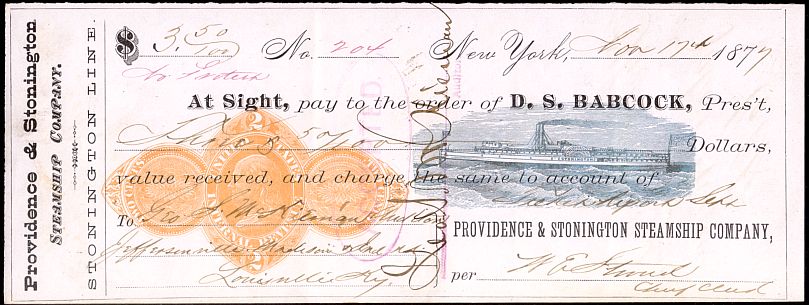

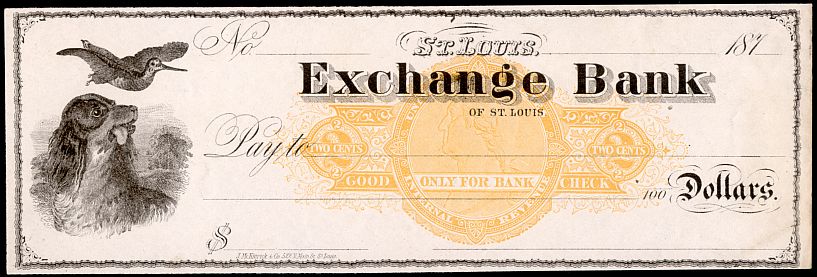

Checks

A Check is a written order to a bank, drawn by a depositor, directing the payment of a specific sum of money to the party named, or to his order and payable on demand. This unused check is drawn on the Exchange Bank of Saint Louis, Missouri. It is also an example of a check with a Civil War imprinted revenue (RN-C21 in the Scott Specialized Catalogue).

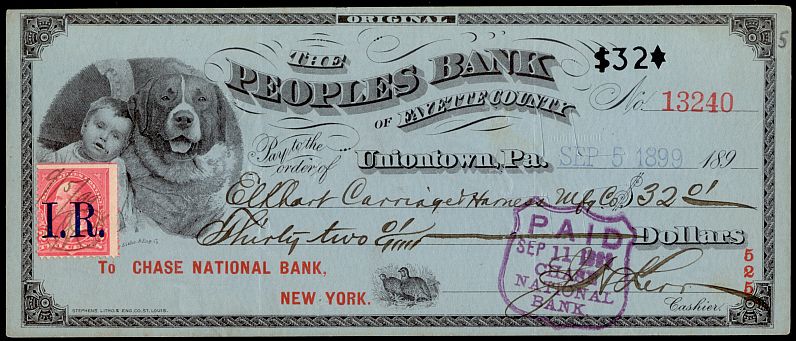

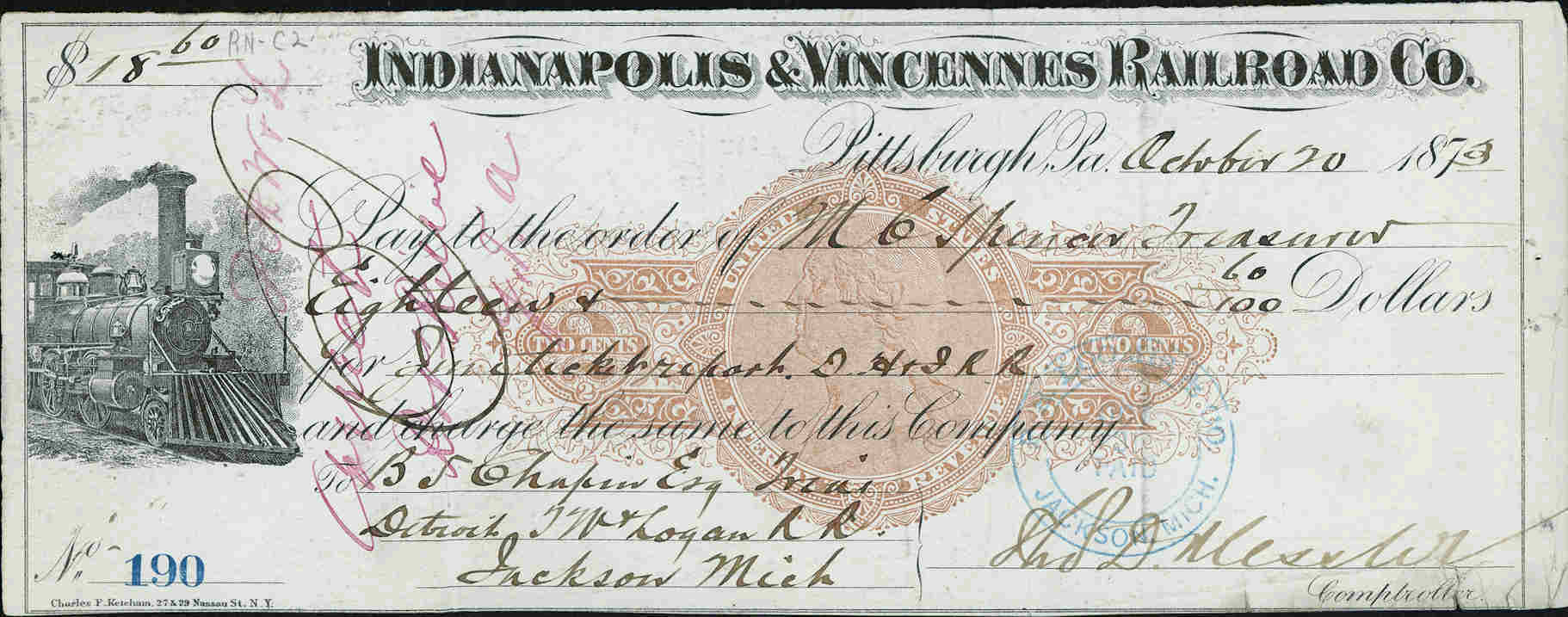

Drafts

A Draft is an order drawn upon an individual or a firm and is used as a means of collecting from an account or a debtor. The parties to a draft are the drawer, the drawee and the payee. This example is a bank draft. The drawer is the Peoples Bank of Fayette County, the drawee is the Chase National Bank, New York and the payee is the Elkhart Carriage and Home Manufacturing Company. The Chase NB was the People Bank’s New York correspondent bank. The draft was paid from funds the Peoples Bank had deposited there. It has a Spanish American War adhesive revenue stamp affixed that pays the two cent tax in effect at the time it was written.

Another type of draft is one in which one merchant draws funds owed by another. The drawer on this merchant’s draft is the Indianapolis and Vincennes Railroad Company and the drawee appears to be the Detroit, Toledo, Wabash and Logansport Rail Road, which owed ticket balances to the Indianapolis and Vincennes. The Treasurer of the drawer is the payee, and no bank is involved. It is a distinctly different type of transaction from a bank draft, but both types of instruments are considered to be drafts. The Civil War revenue on this instrument is an RN-C2.

Bills of Exchange

A Bill of Exchange is a form of draft, usually drawn in “sets” (Original, Second or Duplicate of Exchange, Third of Exchange). Each one was drawn for the same amount but was worded so that only one of a set was paid. In the days when the mails were uncertain, each one of a set was sent to the drawee by a different route and the first one to be received was paid.

This is a Second Bill of Exchange issued by Wells, Fargo & Co. at San Francisco, California and has a 2c blue Bank Note U.S. revenue stamp and an 8c Second Exchange California state revenue stamp.

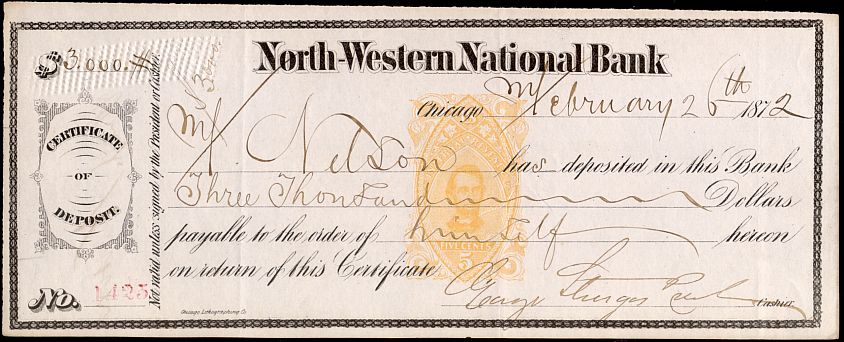

Certificates of Deposit

A Certificate of Deposit is a receipt given by a bank for money deposited. It is negotiable by the payee and redeemable upon presentation. This example has imprinted revenue RN-P5, a five-cent stamp. The Civil War tax on Certificates of Deposit was 2 cents up to $100, 5 cents if over $100.

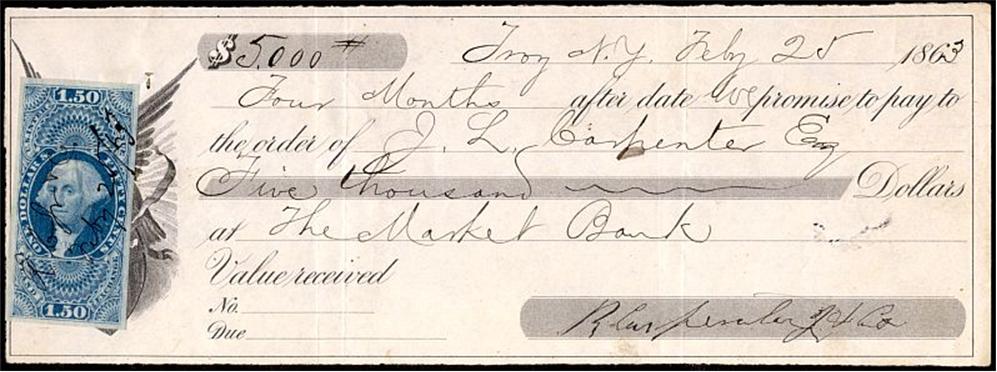

Promissory Notes

A Promissory Note is a written promise to pay a certain sum of money on demand at a specific time. This note has a $1.50 imperforate Inland Exchange revenue stamp (Scott R78a) to cover the tax on promissory notes with a value of over $2,500 up to $5,000.

To revenue stamp collectors, this is an “early matched usage (EMU)” in that it contains the specific stamp to be used on Inland Exchange documents (promssory notes, drafts, domestic bills of exchange).

When revenue stamps were first required, on October 1, 1862, each taxed item was required to have a specific kind of revenue stamp (a Mortgage stamp on a mortgage, a Bill of Lading stamp on a bill of lading, and so forth.) This requirement was lifted on December 25, 1862. After that any stamp could be used on any taxed item except that proprietary stamps could not be used on documents. This document does have the proper stamp and is an EMU. Documents with a “required matched usage (RMU)” are dated prior to December 25, 1862 and are difficult to find.

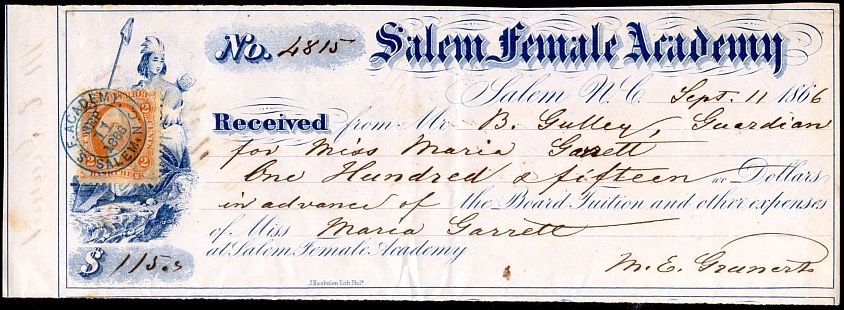

Receipts

A Receipt acknowledges the receipt of money in payment of a debt. Receipts exceeding $20 were subject to a two-cent tax from August 1, 1864 through September 30, 1870. This receipt was issued by the Salem Female Academy to acknowledge the payment of $115 for board and tuition for Miss Marcia Garrett in 1866.